Contrary Research Rundown #23

US chip manufacturing, China, and new memos on Deel, Pachama, and more

Research Rundown

Due to geopolitical tensions, US multinational firms are more cautious about investing in China. S&P Global Market Intelligence data revealed that in 2022, US capital investments in China declined 76% YoY to $7.02 billion from $28.92 billion, and deals dropped 40%. Additionally, US dollar investments in Chinese startups decreased by almost 75% YoY - only 19% of the capital was in USD compared to 39% in 2021.

The White House has been working on a measure to limit U.S. venture capital firms from pouring money into Chinese companies in high-tech areas that could threaten national security, like artificial intelligence and quantum computing. Congress is preparing to propose its plans to restrict US firms from investing in sensitive Chinese tech companies. There’s a bipartisan appetite for policies that look tough on China, which means that legislation restricting outbound investment might have a chance of passing, despite a divided Congress. The US government has been increasingly scrutinizing foreign investments, American investments in other countries, and reliance on China, bringing attention to its domestic capacity of high-tech manufacturing of critical goods like semiconductors.

Since American researchers invented the integrated circuit in the late 1950s, the U.S. manufacturing share has dwindled. Most American chip companies focus on designing cutting-edge products while outsourcing the costly manufacturing to overseas foundries. Semiconductor suppliers and their customers pulled together last year to lobby the Congress to help shore up U.S. chip manufacturing and reduce vulnerabilities in the crucial supply chain. The push led lawmakers to approve the CHIPS Act, including $52 billion in subsidies to companies and research institutions as well as $24 billion or more in tax credits — one of the biggest infusions into a single industry in decades.

In August, Biden’s CHIPS and Science Act injected $52 billion to support US chip production. As of September 2022, the Semiconductor Industry Association reported 277,000 workers in the US semiconductor industry but had a 0% global share of leading-edge semiconductors. Taiwan and South Korea make up 80% of the global foundry market for chip production. Global VC investments in semiconductor startups have declined from 2021 high of $14.5 billion to $7.8 billion as of December 5, 2022, according to PitchBook. To learn more about the evolution of chips, you can read our overview here.

Venture-backed startups like Cerebras Systems and SambaNova are leading the charge in innovation outside public incumbents like Qualcomm, AMD, and Nvidia. Intel acquired venture-backed Nervana Systems for $350 million in 2016 for deep learning training chips, which was then dominated by Nvidia. Cisco bought venture-backed semiconductor company Luxtera for $660 million in 2018. While the funding has fallen, there is renewed enthusiasm for semiconductors in the US ecosystem, given the pandemic-fueled shortages, increased government support, recent developments in artificial intelligence, and changing geo-political climate.

Slice empowers independent pizzerias with a suite of offerings like online ordering, a website builder, a POS, and marketing services to help them compete with pizza chains. To learn more, read our full memo here.

CoinTracker enables consumers to track their crypto portfolio, helping users see their market value, performance, and taxes as they transact with cryptocurrency. To learn more, read our full memo here.

Long Term Stock Exchange is a new SEC-registered national securities exchange intended for companies and investors in every industry who share a long-term vision. To learn more, read our full memo here.

Pachama has developed a carbon credits marketplace and monitoring software to verify carbon offset projects' impact using satellite imagery and LiDAR imaging. To learn more, read our full memo here.

Deel is an all-in-one HR platform that helps companies simplify the management of a global workforce, from culture and onboarding to payroll and compliance. To learn more, read our full memo here.

A human player beat a top AI system in games of Go, using tactics suggested by a computer program that probed the AI system for weaknesses.

SpaceX’s Starlink is testing a Global Roaming internet service. Check out our memo on SpaceX here, and learn more about satellites in our recent overview, "The Satellite Renaissance."

Dow Jones says OpenAI lacks a deal to use WSJ reporters’ work to train its AI; CNN plans to ask OpenAI to pay to license its content. Check out our memo on OpenAI here.

A look at You.com, Andi, and Perplexity, startups that started offering chatbot-enhanced search tools before the new Bing and Google’s Bard came along.

Twitter has recently faced at least nine lawsuits from landlords, consultants, and vendors demanding payments of over $14 million for unpaid bills.

Elad Gil’s blog post on an overview of how startups can build defensibility over time.

Benedict Evan’s latest presentation explores trends in tech through the lens of the new gatekeepers.

Fundraising by venture capital firms hit a nine-year low in the fourth quarter of 2022.

Kara Swisher interviewed Trae Stephens, co-founder of Anduril Industries, on building technology for national defense and AI warfare. Check out our memo on Anduril here.

India and Singapore have linked their digital payments systems, UPI and PayNow, to enable instant, low-cost fund cross-border transfers.

AI startup Hugging Face plans to build its next-gen LLM on AWS and have Amazon offer its tools to AWS customers. Check out our memo on Hugging Face here.

Microsoft signed deals with Nintendo and Nvidia to distribute Call of Duty on their gaming services and consoles. Check out our memo on the gaming company Epic Games here.

RockHealth’s 2022 digital health consumer adoption survey with telemedicine, wearables, and health data-sharing findings.

FirstMark Capital’s Matt Turk’s 2023 machine learning, artificial intelligence & data landscape. The market map features companies we've written about before like Databricks, Snowflake, CockroachDB, dbt Labs, Fivetran, Replit, Gong, 6sense, and more.

Apple hit major milestones in a Jobs-era project to develop noninvasive blood glucose monitoring, part of its Alphabet X-like Exploratory Design Group.

Artifact, the personalized news reader created by Instagram’s co-founders, opens to the public for Android and iOS.

Techcrunch interview with Swedish BNPL company Klarna’s CEO on their expansion in the US.

Ben Rubin, who founded Meerkat and Houseparty, announced Towns, a protocol and a web-based chat app designed to facilitate self-owned, self-governed online communities.

Celebrating Our 100th Memo

We launched Contrary Research in September 2022, less than 6 months ago. In that time, we've dug into companies across industries like fintech, crypto, climate, software, and more. Across that library, we're excited to share that with our most recent batch of memos we've crossed the 100 mark for memos published. And we're just getting started. Contrary Research is the #1 place to get introduced to any private tech company, and that library is only going to get bigger. To review our full list of memos, check out our Reports page here.

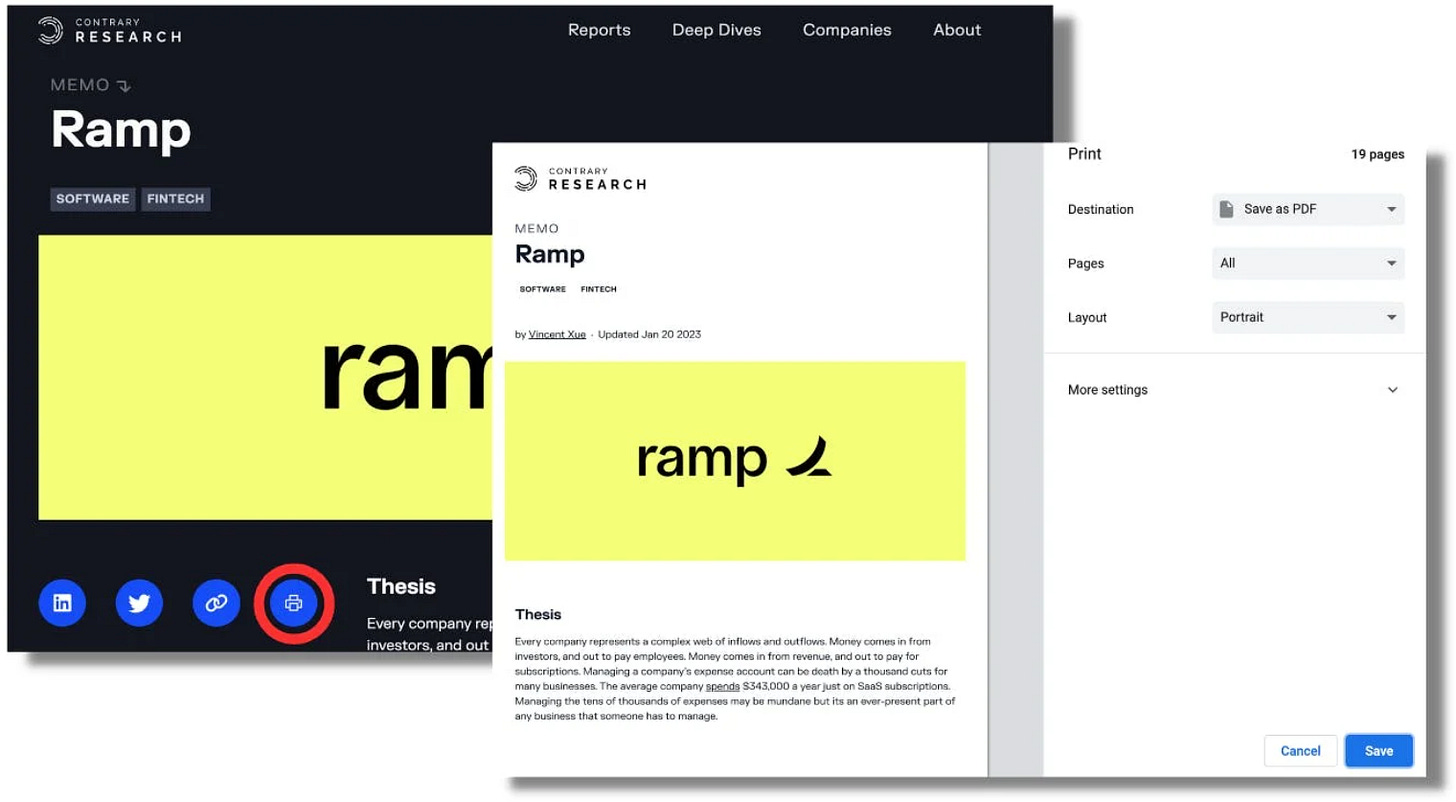

Quality of Life Improvement: Print To PDF

You asked, we listened. The #1 product request we've gotten from our readers was for those of you who like to read our memos in PDF form. We added a print button that will format our memos for an easy, offline, and on-the-go reading experience. To download / print any memo, just look for the print icon on the top left of any memo.