Contrary Research Rundown #44

A breakdown of the payments stack, plus new memos on Lithic, Intercom, and more

Research Rundown

In one of our latest memos this week, Lithic, we went deep in unpacking the payment stack. Here’s an excerpt from the piece:

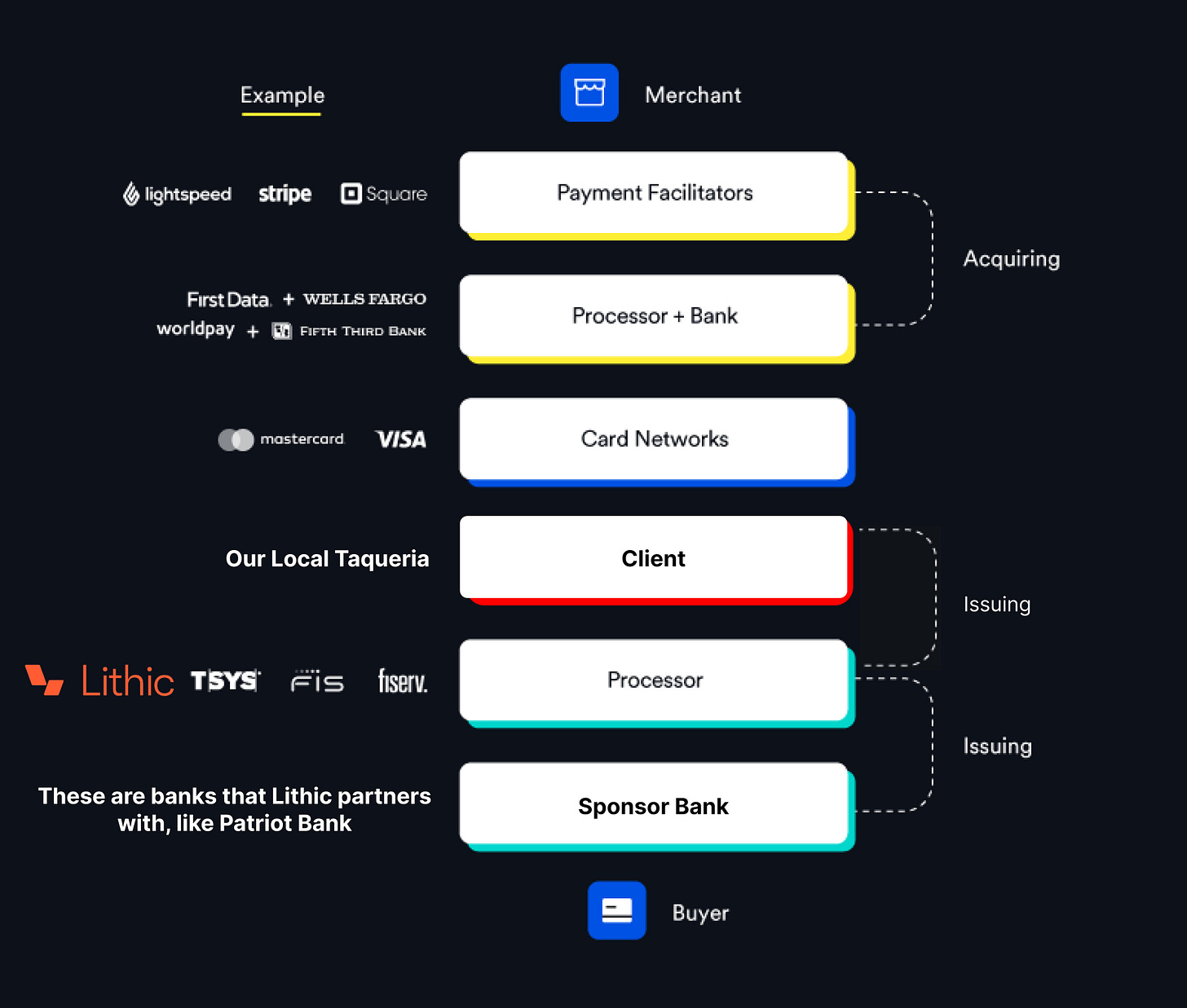

In its simplest form, the payment stack is divided into six core layers. All of these layers operate around a card network (such as Visa or MasterCard), which acts as the core connector between customers and merchants. They can be thought of as follows:

Payment Facilitator: An organization that processes payments on behalf of a merchant. For example, merchants can use Stripe to process their payments.

Acquiring Processor: Once a transaction occurs, the acquiring processor sends a message to check whether the customer’s transaction should be approved. Payment facilitators like Stripe can act as the acquiring processor, but there also exist specific acquiring processors like First Data.

Acquiring Bank: The acquiring bank is the provider of the bank account where a merchant’s money is stored. An example is Wells Fargo.

Card Network: Card network infrastructure facilitates the flow of payments between the merchant and the customer. The two largest are Visa and Mastercard. Essentially, the acquiring processor communicates with the issuing processor via the card network.

Issuing Processor: The issuing processor is asked by the acquiring processor to approve or deny a transaction on behalf of a customer. To do so, the issuing processor communicates with the customer’s bank.

Issuing Bank: The issuing bank houses the bank account of the customer. An example is Bank of America.

To understand how each component of the payment stack interacts, we can consider a simplified example of buying lunch at a taqueria that uses Stripe to process payments.

Once a customer taps their card to purchase lunch, Stripe (which acts as the taqueria’s payment facilitator in this example) sends a message to the acquiring processor to charge their card.

To confirm that this transaction can be authorized, the acquiring processor sends a message (via a card network such as Visa) to the issuing processor to analyze the customer’s bank funds.

The issuing processor then communicates with the customer’s issuing bank (the bank that issued the customer’s debit card) to confirm whether they have enough money in their bank account. If they do, the issuing processor authorizes the transaction.

In order for the taqueria to be paid, the issuing bank (which is the customer’s bank provider) transfers the funds to the acquiring bank (which is the merchant’s bank provider). The acquiring bank then deposits the money into the merchant’s bank account and completes the transaction lifecycle.

The majority of innovation in fintech has occurred in the acquiring portion of this payment stack–specifically, in the payment facilitation segment. For example, payment facilitation companies like Stripe, Paypal, Square, and Lightspeed have a combined market value of over $500 billion. In other words, these companies have powered the growth of the internet and enabled merchants to accept and process payments. Yet, the issuing portion of the payment stack has received significantly less attention and has “lagged the card acquiring side by five to seven years”.

The reason why is that large issuing banks have historically owned the customer relationship, thus receiving the majority of interchange value (i.e. the transaction fees that merchants pay). Customers normally transact with a debit card or credit card from these large banks, such as Chase. But the rise of embedded financial products has changed this.

Today, companies are able to offer financial products to customers, such as branded reward debit cards. This means that the cards being used by customers can now also be issued by fintech companies, marketplaces, vertical SaaS companies, main-street brands, and other non-banks in partnership with smaller regional and community-sponsored banks. Therefore, instead of just the country’s largest banks eating all of the interchange economics generated by debit and credit card spending, new players including merchants themselves are beginning to take more control over the customer relationships.

To explain why owning the customer relationship is so valuable for a company, we can again consider the example of a taqueria that sells $10 tacos. Of the $10 a customer pays, $9.75 goes to the taqueria, $0.20 to the traditional issuing bank, $0.035 to the issuing and acquirer processors, and $0.015 to the card network. While losing $0.20 to an issuing bank doesn’t appear to be a significant loss for the taqueria, the costs add up significantly over time. For example, it is estimated that Target’s net profit would increase by 65% if interchange fees were eliminated.

On the other hand, if the taqueria could launch its own card program for customers, it could own the customer relationship and not lose out on interchange revenue. This is because the card being used by the customer would now be the taqueria’s own debit card, reducing the leakage to the issuing banks of the various cards that the taqueria’s customers happen to use.

In this new scenario, the issuer bank’s primary role would be to provide the Bank Identification Number that is required to transact (any issuer who wants to launch a card program needs a BIN which must be sponsored by a chartered bank). As a result, regional and community banks are increasingly adopting the sponsor banking model to grow their fee-based revenues while leaving the customer-facing relationship management work to fintech companies and brands.

This means that the $0.20 interchange fee that large, legacy issuing banks previously took can instead be split between the taqueria and issuer processor, with a smaller portion going to the sponsor bank. Further, by implementing features such as reward points, companies can also benefit from indirect financial benefits like building loyalty among their customer base. Overall, the new model, powered by the rise of embedded financial products, has created a new payment stack with the client (e.g. the taqueria from the example) appearing in the issuing segment as well.

This is the new workflow for a customer purchasing lunch at the taqueria:

Once a customer taps their taqueria-issued card to purchase their lunch, Stripe (which acts as the payment facilitator for the taqueria) sends a message to the acquiring processor to charge the customer’s card.

To confirm that this transaction can be authorized, the acquiring processor sends a message (via a card network such as Visa) to the issuing processor to analyze the customer’s bank funds.

The issuing processor then communicates with the sponsor bank (the bank that the taqueria partnered with to create debit cards) to confirm whether the customer has enough money in their bank account. If they do, the issuing processor authorizes the transaction.

In order for the taqueria to be paid, the sponsor bank transfers the customer’s money to the acquiring bank (which is the merchant’s bank provider). The acquiring bank then deposits the money into the merchant’s bank and completes the transaction lifecycle.

This opportunity to innovate in the issuing segment of the payment stack has resulted in a new wave of modern issuer processors, like Lithic, to emerge.

To learn more about Lithic, and its competitive position in the payment stack, be sure to check out our full memo.

Intercom is a customer interaction platform that includes chatbots, messaging, and automation for customers to engage with customers both for support and marketing purposes. To learn more, read our full memo here.

BetterUp is a “human transformation platform” that, through virtual coaching, seeks to help individuals, organizations, and teams achieve their highest potential of performance. To learn more, read our full memo here.

Squire is building an all-in-one platform tailored to barbershops. To learn more, read our full memo here.

Lithic provides the infrastructure to let companies issue physical and virtual cards to process transactions and ultimately own the customer relationship via a customized card program. To learn more, read our full memo here.

Nikhil Trivedi, GP at Footwork, published a piece called “The Billion Dollar Revenue Club” outlining how its much more rare to reach $1 billion in revenue than it is to reach a $1 billion valuation, citing several of the companies we’ve covered like Canva, SpaceX, Databricks, Instacart, Stripe, and more.

Barrett Brooks wrote a deep dive called “The Alchemy of Carbon Removal: How Charm Industrial Plans to Run Oil Wells in Reverse and Turn Corn Into Steel.” The piece breaks down both the advancements occurring in carbon removal, and the role that Charm Industrial is playing in that movement.

The Information recently reported that AI companies like Jasper and Mutiny have conducted layoffs, with cuts of up to 30% of their staff in some cases, and have seen several executive departures in others.

Also reported by The Information; Character.ai is in talks to raise additional capital, supposedly looking to raise $150 million at a $1 billion valuation.

Last year, Nvidia’s proposed $40 billion acquisition of Arm fell through, leaving the company independent. Now, reports indicate the company is considering bringing Nvidia in as an anchor investor in Arm’s upcoming IPO.

Redpoint released their InfraRed Report, highlighting data infrastructure and security companies like Wiz, Snyk, Hex, Railway, and others.

Anu Hariharan, who was previously a Managing Partner at YC’s Continuity Fund, and an investor in Monzo, shared a breakdown of how Monzo’s story represents one of the “best turnarounds in the last decade.”

Reports indicate that SpaceX "expects to bring in about $8 billion in revenue in 2023, roughly doubling its revenue from the previous year". You can learn more about SpaceX in our memo.

Block (fka Square) has filed a antitrust lawsuit against Visa and Mastercard, accusing the two companies of conspiring to inflate fees on interchange they charge to payments companies like Block.

Microsoft has announced its plan to charge $30 per month for access to generative AI features across its suite of products.

McKinsey has announced its selection of Cohere as a partner to help clients adopt generative AI capabilities. You can learn more about Cohere in our memo.

Kourosh Shaf shared a breakdown comparing Adyen’s financials to what is known about Stripe’s financials. While Adyen $1.4 billion of net revenue in 2022, Stripe had $3.2 billion. However, Adyen generated $766 million of EBITDA in 2022, while Stripe had an $80 million negative EBITDA. You can learn more about Stripe in our memo.

The creator economy is supposedly alive and well, with recent reports that Kylie Jenner has pivoted into the space by launching a digital fan club for artists called Stanly.

Deel CEO, Alex Bouaziz, appeared on the Asia Tech Podcast, sharing his story of arriving in the US from Israel, not speaking a word of English, and how he built Deel into a $7 billion company. You can learn more about Deel in our memo.

Postman, which previously has raised $433 million from firms like Coatue, CRV, and Bond, has acquired Akita, an API endpoint detection management platform.

Tome, an AI-powered platform for creating presentations, has reportedly reached 10 million users in just 10 months since launching.

Several anonymous Twitter accounts, who had previously interacted with Elon Musk on the platform, wrote a deep dive laying out how Musk could conduct a recap on Twitter’s LBO to try and shift more of the company’s financing to convertible notes, aligning potential equity holders more closely with the company’s vision compared to debt holders.

Carta shared data from its platform indicating that, as of Q2 2023, startup shutdowns have increased 107% year-over-year since 2021, and 45% since 2022.

We’re excited to announce that Contrary Research will be hosting Ian Spear of Faire, Melissa Chan of Uber Eats, and Lydia Lemoine (ex-Gopuff) for a product-led conversation around balancing marketplaces. Join us this Thursday, July 27th for an intimate conversation led by Contrary Principal Megan Kao as we dive into Balancing Marketplaces. Express interest in joining us here. Space is limited so sign up soon!