Contrary Research Rundown #69

Corporate VCs step up in a down market, plus new memos on DroneUp, Flutterwave, and more

Register here for our next Tech Talk on Jan 30th, 2024, in SF - featuring founders & senior engineering leaders from Stytch, Figma, Linear, and Hex! Hosted by Contrary’s tech team, it’s an evening built by engineers for engineers — each company will live demo their latest features for leading builders in the Bay.

Research Rundown

Venture funding in the US over the course of 2023 was down 30% from 2022, which had already declined dramatically from a high of over $345 billion in 2021. However, not everyone is sitting on the sidelines. When you look at total venture funding, there are a few notable players: corporate VCs.

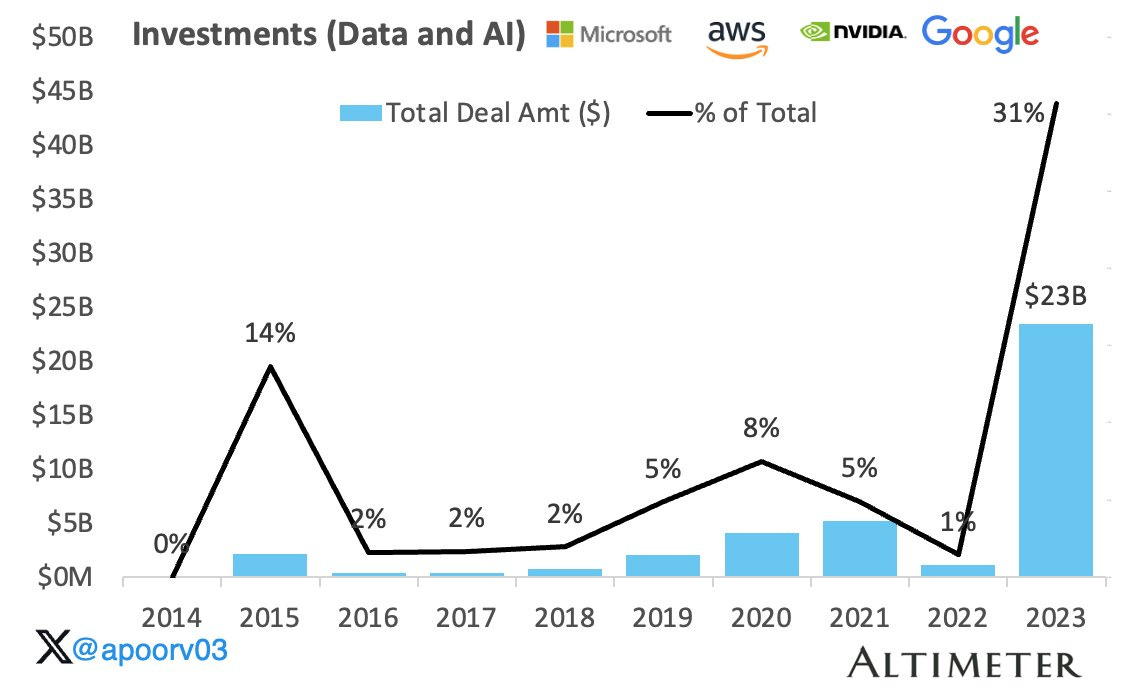

Take AI for example. Investments made by companies like Microsoft, AWS, Nvidia, and Google represented 31% of venture funding going into AI in 2023.

Obviously, AI is a unique category that attracts a lot of corporate alignment. We’ve written before about how massive investments in AI are largely an extension of the cloud computing wars. But it isn’t just AI that is attracting corporate interest.

Recently, Flexport announced it had raised $260 million from Shopify in an uncapped note. Shopify had previously taken a stake in Flexport, after offloading its struggling logistics division to Flexport in exchange for equity. While Flexport has reportedly struggled after seeing an initial COVID boom, the massive capital infusion from Shopify is a clear indication of excitement about the company’s prospects.

While overall venture declined by 25% in 2022, corporate venture investments only saw a 2% decline. Increasingly, its likely that many large public companies with healthy balance sheets saw the market decline over the last few years as temporary negative sentiment, and took the opportunity to continue to build meaningful partnerships with interesting startups.

Now, the remaining question will be whether those investments will pay off going forward. Or if they represent corporate hubris if economic conditions continue to worsen.

DroneUp is a drone delivery service provider that enables companies to enhance their operations with scalable last-mile drone delivery. To learn more, read our full memo here and check out some open roles below:

Flight Test Specialist - UAS Operator - Virginia Beach, VA

Quality Assurance Lead - Autonomy & Robotics - Virginia Beach, VA

Productboard is a software platform that helps product managers gather customer feedback, prioritize features, and build roadmaps to create products. To learn more, read our full memo here and check out some open roles below:

Sales Engineer - Remote

Senior Staff Software Engineer - San Francisco, CA

To learn more, read our full memo here and check out some open roles below:

AVP, Risk Analytics - Singapore

Senior Associate, Acquiring and Switching - Nigeria (Hybrid)

Check out some standout roles from this week.

Vanilla - Senior Business Development Representative, Customer Success Manager

Check - Engineer, Engineer Manager, Partner Success Manager, Controller

Pave - Product Designer, Sr Technical Recruiter, Product Manager

Sam Altman is reportedly in talks to raise tens of billions in order to pursue a vision of building a chip fabrication company. Altman’s ouster in November 2023 was reportedly driven by the discomfort OpenAI’s board felt about his ambitions, including projects like this. Reportedly, the search to fill OpenAI’s board is still ongoing, leaving Altman to pursue these types of ambitious projects.

The World Economic Forum, this past week, included a number of high profile talks on AI, with perspectives shared from the likes of Satya Nadella, Yann LeCun, Nicholas Thompson, Kai-Fu Lee, Daphne Koller, Andrew Ng, and Cohere CEO, Aidan Gomez.

Reddit reportedly has plans to pursue an IPO in March 2024, after having previously looked at an IPO in December 2021. Reddit’s last valuation was $10 billion, but has reportedly been marked down by ~40-60%. Previous reports indicated the company was expecting to end 2023 at $800 million of revenue. To learn more about Reddit, check out our memo.

Meta is, reportedly, “all in on open source AI.” The company revealed that by the end of the year it would have “340,000 of Nvidia’s H100 GPUs,” and that it was training its next generation model, Llama 3. To learn more about the openness of AI, check out our deep dive.

Speaking of Meta, one executive shared that while the company had seen ~$50 billion in losses due to investment in the company’s Metaverse, they still expect to see the vision play out over the course of the next decade.

Discord announced it has laid off ~17% of its employees. The company indicated that though it has raised $1 billion in funding, it still has $700 million on its balance sheet, and is pursuing plans to become profitable in 2024. To learn more about Discord, check out our memo.

DailyPay announced a new equity funding round of $75 million, with $100 million of debt, at a 75% valuation increased to $1.75 billion. A rare up round in fintech, which saw a 40% in funding going to the category.