Contrary Research Rundown #73

The story of AI and "What else is there?", plus new memos on Razorpay, Rapyd, and more

Research Rundown

If you spend any time online, whether as a founder, operator, or investor, AI can feel all-encompassing. It is everywhere and in everything. And rightfully so; there are dramatic implications for the things getting released (what feels like) every day! But for a lot of people, their inclination is that AI is the only thing worth paying attention to.

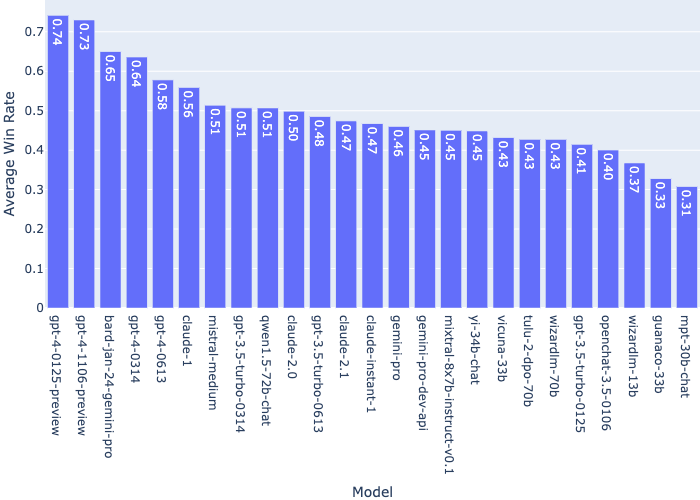

There’s some important nuance there. The vast majority of both capital and attention has been focused on foundation models, particularly those produced by companies like OpenAI, Anthropic, Google, Meta, Mistral, and others.

Beyond a core argument of performance, there’s the never ending debate between proprietary and open models (a topic we’ve dug into as well.) But all of this continues to revolve around core foundation models for generative AI use cases like code completion, text creation, text-to-image, and text-to-video. When people talk about AI being the “fourth major technology wave,” is this what they mean?

While foundation models take up the most attention, if you survey the landscape of both private and public tech companies, you’ll see that the reality is much more nuanced than that. Instead of these core models being the only thing that matters, what really matters are the things that these models can unlock.

For many companies, there are several implications of AI on their businesses, whether that be as core infrastructure or accelerating existing workflows. A few examples:

Copywriting: Startups like Jasper and Writer.com offered early exposure to people who weren’t familiar with generative text models. Jasper was an early customer of OpenAI’s GPT models. But the launch of ChatGPT took away a lot of the initial awe. For these companies, its unlikely their long-term success will come from a specific model. It will be, instead, leveraging these models as infrastructure to support building a specific value proposition. For example, focusing on a feature-rich collaborative system-of-record for managing copy, rather than differentiating on particular models.

Biotech: Drug discovery, research, and trial analysis are all, at their core, data problems. Identifying variables for change and outcomes is a big part of clinical research. The opportunity to leverage AI to accelerate existing biotech research could be significant if done correctly. ChatGPT is unlikely to be much help, but projects like DeepMind’s AlphaFold that have been trained on 100K known proteins may prove more useful.

Industrial Robotics & Defense: One of the biggest areas that have been left out of the generative AI hype cycle include use cases that interact with the physical world. While we’ve seen incredible digital renderings, there’s been more conversation of banning or burning driverless cars than any particular technological breakthroughs, for example. But companies the engage sensors and automation in the physical world can see meaningful advantages come through AI breakthroughs, even when the core infrastructure is not their own. Brian Schimpf, the CEO of Anduril, has explained the advantages that recent AI/ML breakthroughs can have on things like autonomous drones:

“We've been able to weave in all the different aspects of machine learning, and how you actually apply those techniques. It's a tool, not really an end in and of itself. We don't do AI research, we're not interested in any of that. We're looking at how can we best take what is working in the state of the art and apply it rapidly into these into these defense problem sets.”

Rapyd is a fintech company that enables businesses to collect payments in local currencies across the globe, conduct payouts, and maintain digital wallets globally. To learn more, read our full memo here and check out some open roles below:

Compliance Operation Analyst - United Kingdom

Demand Generation Specialist - United Kingdom

Razorpay is an Indian financial technology platform providing end-to-end payment solutions allowing businesses to accept, process, and disburse payments. To learn more, read our full memo here and check out some open roles below:

Principal Solutions Architect - Bangalore

Analyst - Business Operations - Bangalore

Guild, formerly Guild Education, is an education-as-a-benefit company which gives employees access to a marketplace of vetted degree programs and certificates to help employees upskill and reskill To learn more, read our full memo here.

Check out some standout roles from this week.

Snorkel | Hybrid / Redwood City, CA - Software Engineer — AI/ML Systems, Software Engineer — Backend, Software Engineer — Frontend, Software Engineer — Full Stack, Software Engineer — Infrastructure

Codeium | Mountain View (HQ), CA - Full Stack Product Engineer, Software Engineer, Software Engineering Intern

The biggest news in AI this week; OpenAI announced its new text-to-video model, Sora. The example videos are pretty incredible. This also raises a lot of questions for other text-to-video companies like Runway and Midjourney.

In other AI news, Google released Gemini Pro 1.5, an AI model with over 1 million token context length, which is dramatically larger than other models like GPT-4 Turbo and Claude 2.1.

In December 2023, 23andMe confirmed a hack that was previously disclosed in October, had impacted the personal data of 6.9 million users! CEO Anne Wojcicki expresses optimism for the company. Meanwhile, the company’s market cap has sunk from a high of nearly $6 billion in late 2021 to ~$375 million today.

Rippling has announced expansion into Australia as a new market. The expansion is notable because even large HRIS competitors, like Gusto, have avoided much international expansion.

E-commerce startup, Bolt, has slashed its valuation from $11 billion in late 2021 to $300 million as it repurchases shares from investors. That valuation represents ~1x the amount of cash Bolt still has on the balance sheet.

As of Q4 2023, there was still a healthy appetite for secondary shares in certain startups. The top of the list includes SpaceX, Stripe, OpenAI, Databricks among others.

Logistics has been a pretty volatile category over the last 5 years from COVID to the massive rise in ecommerce, and eventual pullback. Flexport has struggled recently. Meanwhile, Shipbob has reportedly hired bankers to target an IPO at a $4 billion valuation.

Databricks’ CEO, Ali Ghodsi, shared his perspective on the limitations of LLMs. The Information summarizes: “Large language models that power today’s chatbots leave a lot to be desired... To turn them into a truly big business, the models need ways to access real-time data in a reliable way, otherwise known as retrieval augmented generation (aka RAG).”

Ghodsi also opined on the possible drop in chip prices in the near-future. “We're gonna see amazing small models that absolutely can be served on the edge, and you don't even need specialized hardware to serve it really, you don't need GPUs even to serve that.”