Contrary Research Rundown #84

Crossing the IPO chasm, plus new memos on Radiant Nuclear, Glean, and more

On May 22nd, we're hosting our next Tech Talk with Ramp, Hex, Sourcegraph, Semgrep, Onehouse, and Weaviate in San Francisco. The evening will feature eng demos and conversations with senior leaders from the featured companies, followed by food and drinks. Register for the chance to join!

Research Rundown

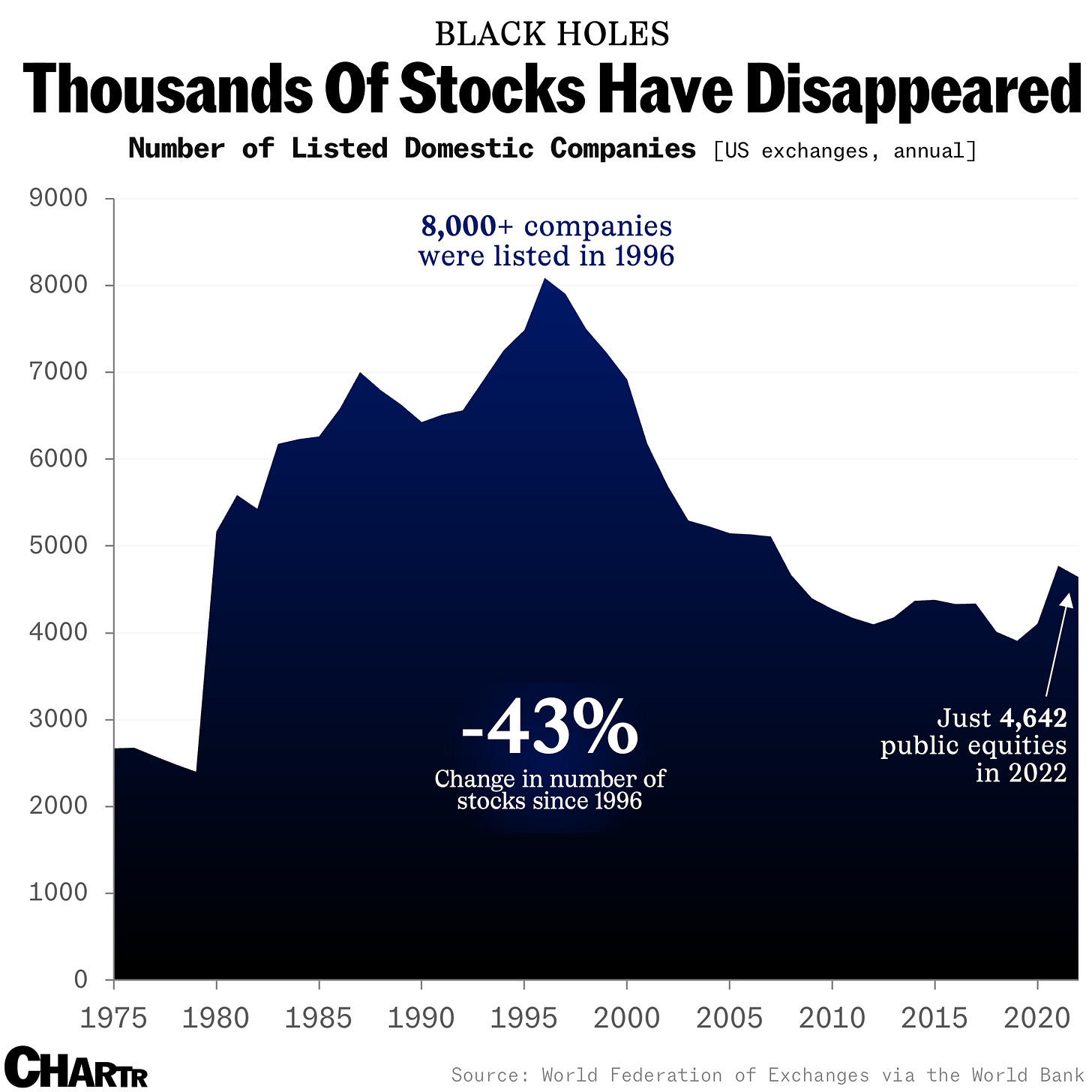

There are, increasingly, fewer and fewer public companies. That’s what a new report from Sherwood News, Robinhood’s research arm, unpacked. But the bigger question is why?

The report points to a number of possible reasons, including increased regulation like SOX, and increased amounts of private capital from PE and VC. While certainly some of the story, Sherwood points to one 2023 academic paper that argues the “Magnificent Seven” (Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta and Tesla) have started to eat a lot of the public companies. These companies have, collectively, acquired over 870 companies.

Meanwhile, you have a number of viable contenders sitting on the sidelines staring across the chasm of going public. SpaceX ($150 billion valuation), Stripe ($50 billion), Databricks ($43 billion), and on and on. For some, like SpaceX, there’s a specific logic. Elon Musk already doesn’t love being a public company with Tesla, and has said he wouldn’t take SpaceX (or even Starlink) public until their revenues are more predictable.

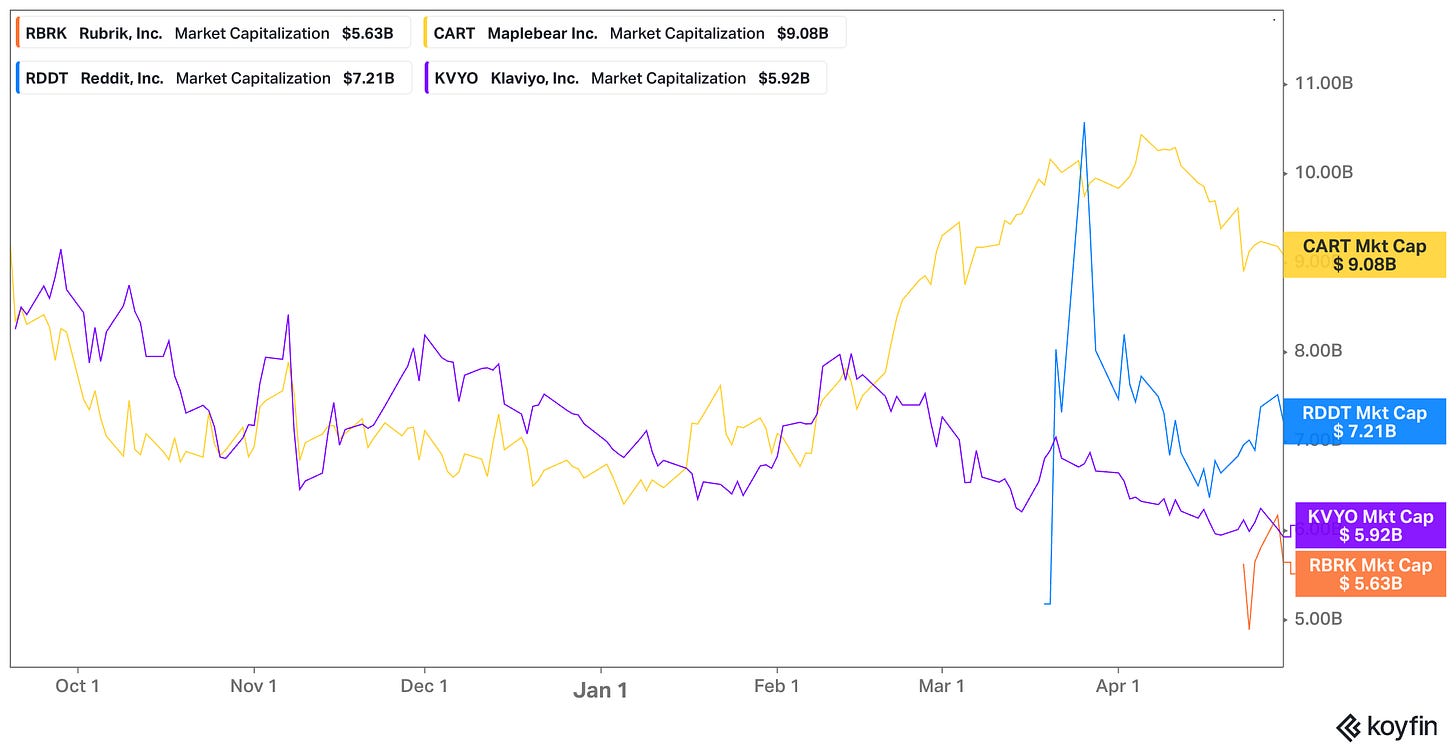

And while many point to IPO conditions as a stalling point for many of these companies, you only need to look at the performance of several recent examples, like Instacart, Reddit, Klaviyo, and Rubrik.

All of them have had relatively steady performance since their IPO, with very few of the stark drop-offs and 90% value reductions that we saw with the crop of 2021 IPOs and SPACs. Even for Reddit, which has a fraction of the scale of other social media giants, and is still unprofitable.

But for many companies, becoming a public company remains a difficult chasm to cross. Apprehensions about how they’ll be received as a public company can be debilitating for a number of companies. Especially when, as we’ve seen for companies like OpenAI, Databricks, and Rippling, there is still plenty of appetite for private capital and even capital to support employee tenders to generate liquidity for early believers.

Radiant Nuclear, also known as Radiant, builds portable nuclear microreactors that are intended to replace diesel generators in “remote villages” and to provide “resilient backup power for hospitals, data centers, and military installations. To learn more, read our full memo here and check out some open roles below:

DevOps Engineer - El Segundo, CA

Software Simulation Engineer - El Segundo, CA

Glean is a productivity startup that has developed a smart enterprise search assistant by indexing and understanding the context of documents from dozens of products through the use of 100+ APIs. To learn more, read our full memo here and check out some open roles below:

Product Designer - Palo Alto, CA

Software Engineer, Frontend - Palo Alto, CA

Boom Supersonic is an airplane manufacturer that is developing supersonic airliners. To learn more, read our full memo here and check out some open roles below:

Airframe Structures Engineer - Technical Specialist 2 - Centennial, CO

Electro-Mechanical Engineer - Technical Specialist 2 - Centennial, CO

Check out some standout roles from this week.

Semgrep | San Francisco, CA - Full Stack Web Developer (Marketing), Senior Software Engineer, Full Stack

Traba | Remote, NYC - Software Engineer, Lead Product Designer

Ali Ghodsi, the CEO of Databricks, did an interview with Stratechery where he talked about, among other things, the importance of “going after the big guys.” Clearly something the company has done in releasing models like DBX, acquiring MosaicML, and increasingly competing with Snowflake.

Stanford released its 2024 Artificial Intelligence Index Report. Some key takeaways include AI’s ability to already surpass human performance at a number of tasks, and the US’s lead in producing foundation models. Regulation, however, is still waiting on the horizon.

The Guardian published a piece on the rise of Shein, which has already become the largest fast-fashion retailer by sales in the US, and generated $22 billion in revenue in 2023.

Arthur Mensch, the CEO of Mistral, went on 20VC to talk about how he believes both applications and models will get thinner, but that models will still be big enough to need a platform for vertical applications. Mistral wants to be the open platform to OpenAI’s proprietary one. Check out more in our deep dive.

Ramp released a report on AI spending across companies. The report indicated that, based on the number of customers, OpenAI, Midjourney, and Anthropic were the leading AI vendors. But by mean card spend, the top of list included the likes of Databricks, Mistral, and Pinecone.

Walmart announced its closing down Walmart Health that it launched in 2019. Blake Madden unpacked the details and, in particular, why retail health is such a difficult business.

Turkey-based quick delivery company, Getir, has announced plans to pull back from other European countries, like Germany and the U.K., and focus exclusively on its home market.

Itai Damti, the CEO of Unit, unpacked the evolution of banking-as-a-service on a recent podcast. You can also read more in our deep dive, The Great Bank Unbundling.

At Contrary Research, our vision is to become the best starting place to understand private tech companies. We can't do it alone, nor would we want to. We focus on bringing together a variety of different perspectives.

That's why we're opening applications for our Research Fellowship. In the past, we've worked with software engineers, product managers, investors, and more. If you're interested in researching and writing about tech companies, apply here!